Mancaron was approved by the Shenzhen Stock Exchange, and Richem's jewelry performance continued to grow

Release time:2023.01.20 09:36:33

Gross domestic product (GDP) grew by 3 per cent year on year in 2022

The gross domestic product (GDP) in 2022 was about 121 trillion yuan, up 3% at constant prices from the previous year, with the primary industry up 4.1% to about 8.8 trillion yuan, the secondary industry up 3.8% to about 48.3 trillion yuan, and the tertiary industry up 2.3% to 63.9 trillion yuan, according to the National Bureau of Statistics.

Total retail sales of gold, silver and jewelry fell 1.1% year-on-year in 2022

Data from the National Bureau of Statistics show that in December 2022, the total retail sales of consumer goods fell by 1.8% year-on-year to 4,054.2 billion yuan, of which the retail sales of consumer goods other than cars fell by 2.6% year-on-year to 3,543.8 billion yuan; Retail sales of gold, silver and jewelry in units above designated size fell 18.4 percent year-on-year to 24.5 billion yuan.

In 2022, the total retail sales of consumer goods decreased by 0.2 percent year-on-year to 439,773.3 billion yuan, of which the retail sales of consumer goods other than automobiles decreased by 0.4 percent year-on-year to 39,396.1 billion yuan; Retail sales of gold, silver and jewelry in units above designated size fell 1.1 percent year-on-year to 301.4 billion yuan.

China's gold jewelry consumption fell 8 percent in 2022 from a year earlier

Statistics from the China Gold Association show that China's gold consumption in 2022 fell 10.63% year-on-year to 1,001.74 tons, of which gold jewelry fell 8.01% year-on-year to 654.32 tons, gold coins and bars fell 17.23% year-on-year to 258.94 tons, and industrial and other gold fell 8.55% year-on-year to 88.48 tons.

Chow Tai Fook has over 7,000 stores in mainland China

Chow Tai Fook recently announced its operating data for the quarter ended December 31, 2022. The total retail value of the group decreased by 19.3% year-on-year during the reporting period.

The same-store sales in Hong Kong SAR and Macao SAR decreased by 7.8% year-on-year, of which the same-store sales of gold jewelry and products decreased by 11.4%, and the proportion of total sales decreased from 67.9% in the previous quarter to 65.3%. Like-for-like sales of inlaid, platinum and K-gold jewelry fell 2.9 percent, with total sales rising to 26.4 percent from 23.7 percent in the previous quarter.

Same-store sales in mainland China decreased by 33.1% year-on-year, of which the same-store sales of gold products decreased by 35.8%, and the proportion of total sales decreased from 78.0% in the previous quarter to 76.8%. Set, platinum and K gold jewelry same-store sales fell 31.8%, and total sales rose to 18.4% from 17.8% in the previous quarter.

During the reporting period, the Group registered a net increase of 448 to 7,016 Taifuku Jewelry stores in the mainland China market, of which 76% were franchised stores; The Group's total number of stores worldwide increased by 436 net to 7,404.

Sales pick up ahead of China's Golden Holiday

Recently, China Gold answered questions on the recent sales situation, the impact of gold price fluctuations on sales, and the layout strategy of cultivating diamonds in the investor survey activity.

In terms of recent sales, the company said that with the release of the new epidemic prevention policy ten and the turnover of personnel brought by the Spring Festival, the customer flow of most of the company's stores has increased significantly and the consumption heat is high.

In terms of the impact of gold price fluctuations, the company said that the main customer group of investment products is more sensitive to the gold price, and more choose to wait and see in the volatility period.

In terms of cultivating diamond business, the company said that it would focus on online layout and brand promotion in the early stage, and guide the subsequent offline consumption scene to land based on the data and consumer portraits obtained from online channels.

International Trends

The strong jewelry business drove Richemont's growth

In the fourth quarter of 2022, Richets jewelry division sales rose 11% year over year to $4.03 billion, watch division sales fell 3% year over year to $1.03 billion, and total group revenue rose 8% year over year to $5.84 billion.

From April to December 2022, Riche峰's jewelry division sales rose 19% year over year to $10.89 billion, watch division sales rose 13% year over year to $3.24 billion, and total group revenue rose 18% year over year to $16.31 billion.

Fosun Group considers sale of International Gemological Institute (IGI)

Recently, the International Gemstone Institute (IGI, hereinafter the same) CEO and shareholder Roland Lorie confirmed to the media Fosun Group considering the sale of IGI news, and said that the move is conducive to the international Gemstone Institute into a new growth stage, and will not affect its independent operation. The institute is currently valued at about $215 million and is 80 percent owned by Yuyuan Holdings, a listed unit of Fosun Group.

De Beers adjusts rough diamond prices

De Beers recently cut the average price of rough diamonds above 2 carats by 10 per cent, while raising the price of rough diamonds below 0.75 carats by about 10 per cent.

Dior is building an ice and snow themed store in Jilin

French luxury brand Dior recently unveiled an ice and snow boutique in the Songhua Lake resort in Jilin Province, bringing the brand's latest ski collection and creating a large ice sculpture art palace and a "dome snow house" cafe.

Rio Tinto Group's rough diamond production rose in 2022

Recently, Rio Tinto announced that due to the receipt of 40% of the Diavik deposit in Canada from Dominion to achieve 100% control of the deposit, the rough diamond production attributable to the group in 2022 increased by 21% year-on-year to 4.7 million carats. The company expects production from the deposit to be between 3 million and 3.8 million carats in 2023. As Diavik, the only diamond deposit owned by Rio Tinto, dwindled, the company may withdraw from rough diamond mining altogether.

Investment and financing

Mancaron's proposed increase was approved by the Shenzhen Stock Exchange

Recently, Mancaron announced that the company's application documents for issuing shares to specific objects have been approved by the Shenzhen Stock Exchange's issuance and listing review authority, and the Shenzhen Stock Exchange will report to the China Securities Regulatory Commission to perform relevant registration procedures in accordance with the provisions.

Sarine acquires Gemstone Certification and Assurance Laboratories (GCAL) to boost its North American business

Sarine, an Israeli gemstone technology company, has announced that it will acquire a majority stake in New York-based Gemstone Certification and Assurance Laboratories (GCAL) in order to expand its business in the US market. The company said the Gem Certification and Assurance Lab will maintain its executive team and continue to provide services to its customers as they did before the acquisition.

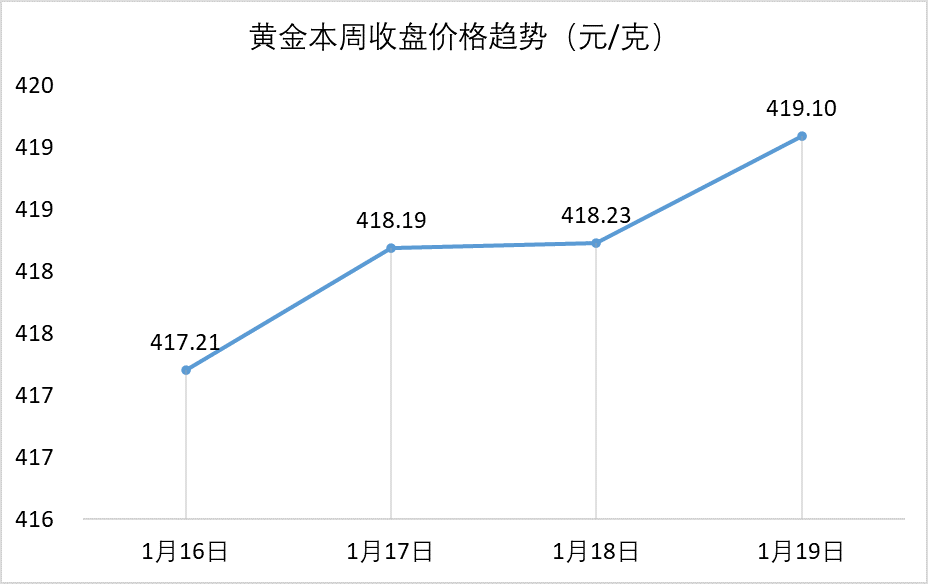

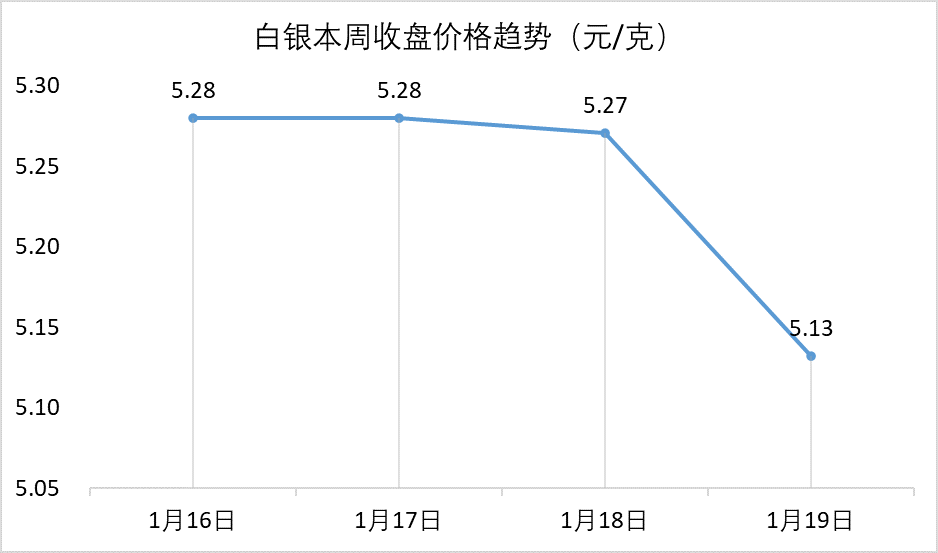

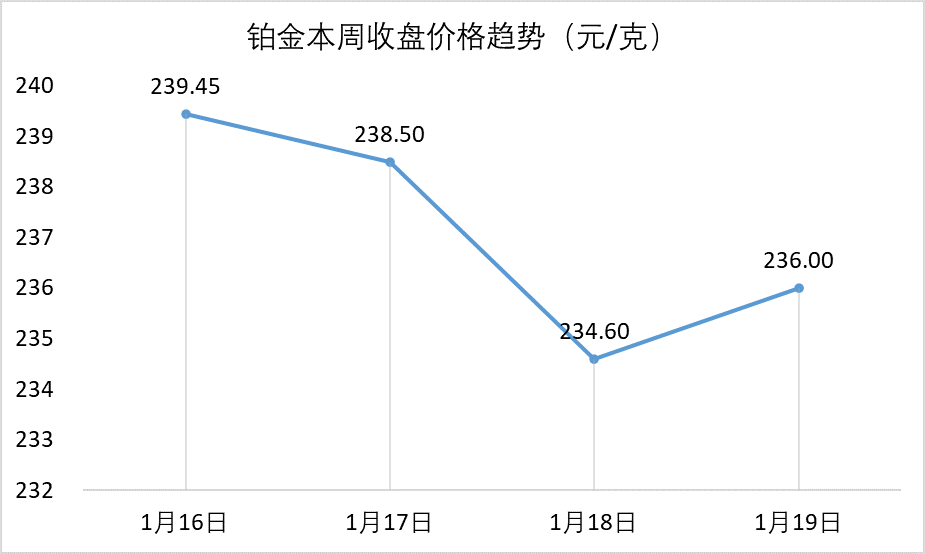

Weekly trend of raw material prices

Special notes:

1. The data is from Shanghai Gold Exchange;

2. The data on January 19 is the closing price at 15:45 on that day.

3. The prices of gold, silver and platinum correspond to the transaction data of Au99.99, Ag(T+D) and Pt99.95 respectively.

* Sources of news related to this article include but are not limited to official websites, announcements and public media platforms of relevant institutions. The information does not represent the views and positions of our company.

* Part of the article pictures are from the Internet, if there is any infringement, please inform us to delete.